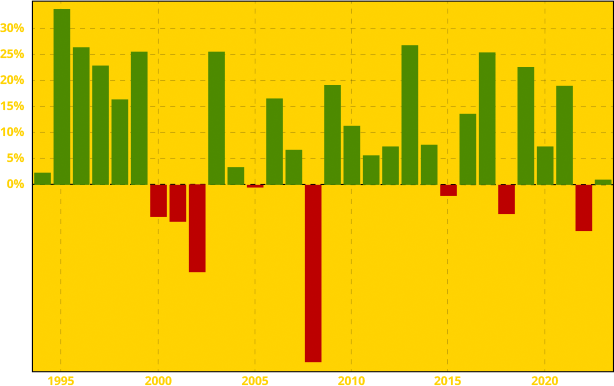

The findings of the 50-year Doctors Economic Research Project demonstrated that periodic losses of savings to risk of principal investments destroy the efficiency of compound interest.

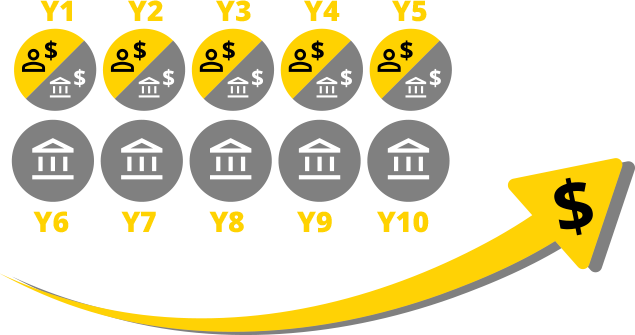

Findings of the Doctors Economic Research Project documented productive individuals’ Great Recession losses of 50% of the value of their personal and qualified retirement plan stock market investments during 2008-2009. The guaranteed principal, guaranteed life income savings management component of the New Economic Order Planning Program that was subsequently developed was able to help these doctors recover their losses within 7 years.

Source: https://macrotrends.net/2622/dow-jones-by-year-historical-annual-returns

Stock market investors who had sufficient time left before retirement age to avoid forced liquidation of risk investment portfolios at a loss to pay lifestyle costs were able to avoid the losses by holding on to their reduced-value stocks However, this did not occur until 2019. These investors lost earnings on their lost savings during that entire decade. Unfortunately, many of these “buy and hold” investors then experienced the Pandemic-caused losses of another 30% of the value of their savings a few months later.

By the end of 2021, many of those investors who, again, held on to their reduced-value stocks recovered the 30% losses and returned to their 2007 pre-Great Recession value. Unfortunately, beginning in 2022, negative domestic and global developments including inflation and war in Ukraine caused market volatility and additional losses of personal and retirement plan savings. Interest rate increases and record national debt levels are causing increasing market volatility in 2023. This history of risk investment’s periodic losses and volatility increases stress levels for savers and interferes with their progress toward retirement savings goals and peace of mind.

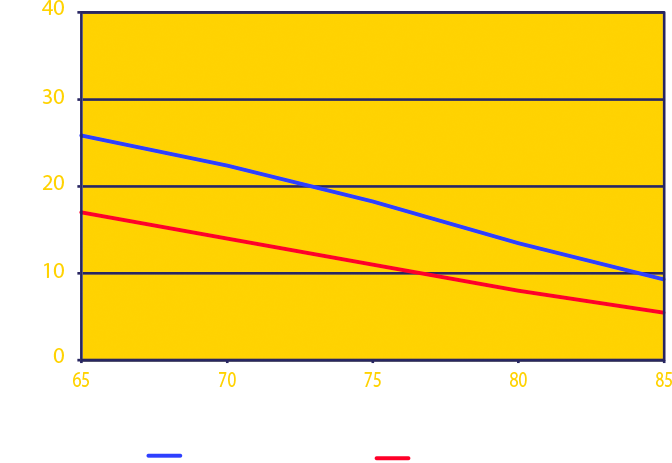

Source: RAND, and Machell, Poterba, and Warshowsky, New Evidence on the Money's Worth of Individual Annuities, 1997

Findings of the Doctors Economic Research Project demonstrated that decreased efficiency of compound interest is caused by losses of surplus earnings to unnecessary income taxes and losses of savings to unnecessary risk of principal stock market investing. The mitigation of these losses by the implementation of personalized, evidence-based earnings management and savings management planning strategies by Doctors Economic Research Association members increases their spendable retirement distributions by $1 million to $10 million.